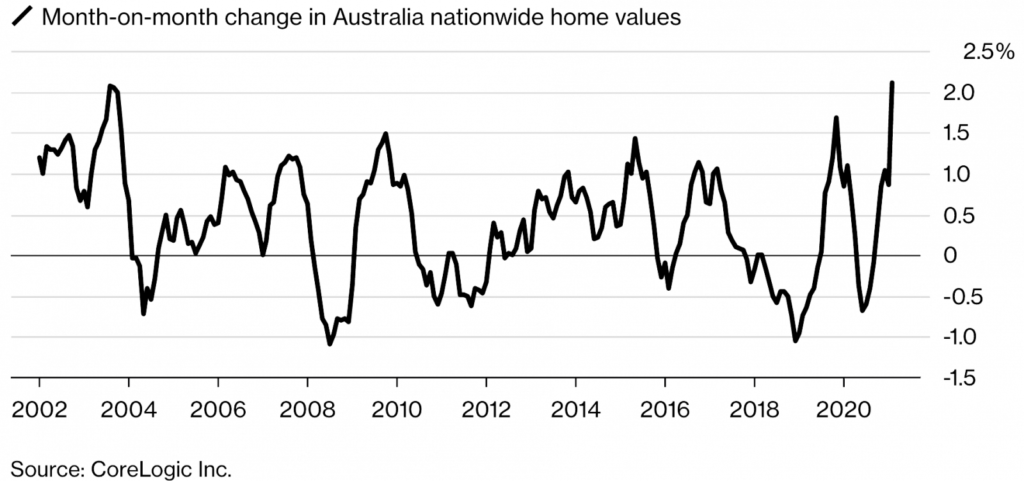

After a year of pandemic payments bolstering mortgage and rent payments and some brief slowing of the economy, property prices in Melbourne saw an increase of 2.5% in February. According to property researcher, CoreLogic, Australia has recorded the highest increase in 18 years.

Stimulus and low-interest rates

Record low-interest rates play a role, with data from the National Housing Finance and Investment Corporation showing federal and state government demand generation schemes are fuelling the take-up by first home buyers. The Australian Bureau of Statistics report released on March 31, 2021, confirms this with an increase of 21.6% in new building approvals.

With $15,000 in grants for new or substantially renovated homes and up to $86,000 total available to new home buyers, it’s unlikely the market will slow within the next two years.

Banks back growth

This is confirmed by research undertaken by the banks. ANZ predicts property to increase by 16% in Victoria over 2021, slowing to 6% nationally in 2022, whilst Westpac predicts a jump of 20% nationally between now and 2023.

That’s not to say it’s easy. Many aspiring homeowners are being priced out of the inner city and considering country towns with regular train services or emerging commuter corridors, where the quintessential Melbourne lifestyle is affordable without compromising on connectivity or community.

New homes in Cranbourne, Tarneit, and Rockbank are delivering on Australian values as well as long-term financial plans for both owner-occupiers and investors with governments committing billions of dollars in infrastructure and planning.

Predictable upward trajectory

Melbourne saw a deeper dip in average prices than any other major capital city, a result borne out of two Stage 4 lockdowns, but the market has rebounded quickly, with listings now averaging fewer days on market as pent-up demand is met.

The ball will keep on bouncing for the property market. The good news is, there are plenty of opportunities to catch it on the way up for a slam dunk in securing future wealth.

Growth in summary

COVID is being managed well across the country with few cases

Manufacturing certainty of vaccination locally by CSL

High auction clearance rates

Loan deferrals are low

RBA unlikely to lift interest rates for three years

Job creation by emerging industries and new technologies

Accelerating consumer confidence

Investor and bank confidence in property